When investors commit to funding a startup, they do so with the anticipation of seeing their investment grow as the company succeeds. But what happens when a startup’s value drops? How can investors protect their stakes from potential losses in such a scenario? Enter the anti-dilution clause—a crucial component of term sheets that helps safeguard investors’ interests against a drop in share value, also known as a down round.

What is Dilution and Why Does It Matter?

Dilution occurs when a company issues new shares, which reduces the ownership percentage of existing shareholders. This is a common aspect of raising capital but can affect investors’ returns if not managed properly.

Let’s break it down with a simple example:

Before New Shares are Issued: Imagine you own 400 out of 1,000 total shares in a company. Your ownership percentage is 40% (400/1000).

After New Shares are Issued: If the company issues 1,000 additional shares, your total shares are still 400, but the total number of shares now stands at 2,000. Your ownership percentage drops to 20% (400/2000).

While dilution is a natural part of financing, it becomes problematic if the company’s value decreases. Without measures to counteract this dilution, investors could see a significant reduction in their equity’s value.

What is a Down Round and How Does It Impact Shareholders?

A down round occurs when a company issues shares at a lower price than previous funding rounds. This results in a dilutive effect on existing shareholders’ equity. For instance:

- Seed Round Scenario: A Seed investor buys 100,000 CCPS shares at ₹50 per share, investing ₹5,000,000.

- Series A Round Scenario: If the share price drops to ₹25, a Series A investor would receive 200,000 CCPS shares for the same ₹5,000,000 investment.

In this scenario, the Seed investor’s shares are worth less compared to the new shares being issued. This dilution can be unfair to early investors, which is why anti-dilution clauses are put in place to protect against such situations.

Key Methods of Anti-Dilution Protection

Anti-dilution clauses are designed to adjust the price per share in the event of a down round. There are three main methods for this protection:

1. Full Ratchet:

This approach adjusts the price per share down to match the new issuance price.

Calculation: The formula for the full ratchet adjustment is:

Full Ratchet

AS = (RAS x RSP/NIP) - RAS

For the purpose of this clause

‘AS’

Additional Shares

‘RAS’

Aggregate Shares Held by Ratchet Holder

‘RSP’

Old Conversion Price

‘NIP’

New Issue Price

2. Broad-Based Weighted Average:

This method adjusts the price per share based on a weighted average of the prices of all outstanding shares and convertible securities.

Calculation: If a company issues new shares at a lower price, the broad-based weighted average takes into account all existing shares, including preference shares, warrants, and options.

3. Narrow-Based Weighted Average:

This method adjusts the price per share based only on the preferred shares that have anti-dilution protection.

Calculation: This method typically results in a smaller adjustment compared to the broad-based weighted average method because it considers only the protected shares.

CP2 = CP1 *(A+B)/(A+C)

For the purpose of this clause

‘CP2’

Adjusted price per share

‘CP1’

Previous round price per share

‘A’

Old Conversion Price

‘B’

New money / Previous round price per share

‘C’

New number of equity shares issuable in the new round

Both the Broad-Based and Narrow-Based Weighted Average Anti-Dilution formulas use the same mathematical formula, but the considerations differ: the Broad-Based method includes all capital instruments, while the Narrow-Based method considers only the preferred shares.

How the Anti-Dilution Protection Clause Works: A Detailed Example

Incorporation and Seed Round

| Investor | Original Investment | Price per Share | No. of Shares | % Holding |

|---|---|---|---|---|

| Founders | ₹750,000 | ₹10 | 75,000 | 75% |

| Seed | ₹250,000 | ₹10 | 25,000 | 25% |

| Total | 100,000 | 100% |

Series A Round (No Anti-Dilution)

Due to market instability, the share price drops from ₹10 to ₹5.

| Investor | Original Investment | Current Value | Price per Share | No. of Shares | % Holding |

|---|---|---|---|---|---|

| Founders | ₹750,000 | ₹375,000 | ₹5 | 75,000 | 37.5% |

| Seed | ₹250,000 | ₹125,000 | ₹5 | 25,000 | 12.5% |

| Series A | ₹500,000 | ₹500,000 | ₹5 | 100,000 | 50% |

| Total | 200,000 | 100% |

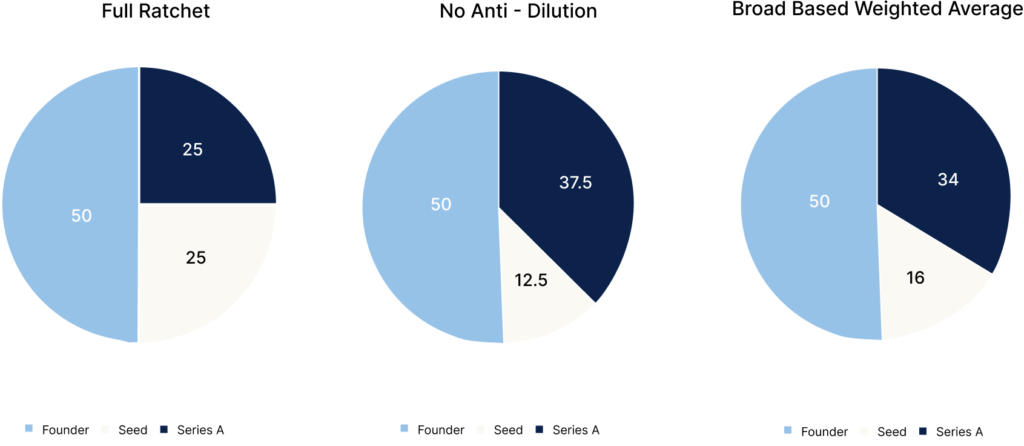

Anti-Dilution Adjustment

1. Full Ratchet

Additional shares to be issued (AS):

AS = (RAS x RSP/NIP) - RAS

= 25000*(10/3.33) - 25000

= 50,000

Adjusted Ownership Structure

| nvestor | Original Investment | Current Value | Anti-Dilution Additional Shares | Price per Share | No. of Shares | % Holding |

|---|---|---|---|---|---|---|

| Founders | ₹750,000 | ₹340,909 | - | ₹3.33 | 75,000 | 25% |

| Seed | ₹250,000 | ₹159,090 | 50,000 | ₹3.33 | 75,000 | 25% |

| Series A | ₹500,000 | ₹500,000 | - | ₹3.33 | 100,001 | 50% |

| Total | 300,001 | 100% |

2. Broad-Based Weighted Average Method

Adjusted Price per Share:

CP2 = CP1 *(A+B)/(A+C)

=10*(1,00,000+50,000) / (1,00,000+1,10,000)

= 7.14

Conversion Ratio = Original Price per Share / Adjusted Price per Share

= 10/7.14

= 1.4

Total Shares Held by Seed Investor at the End of Series A = (Number of Shares Held as on Date × Conversion Ratio)

= 25,000*1.4

= 35,000

Additional Shares to be Issued to Seed Investor = Total Shares Held by Seed Investor - Total Shares Held Previously

= 35,000-25,000

= 10,000

Total Shares Held by Founder and Seed Investor at End of Series A

= 75,000+35,000

= 1,10,000

New Price per Share = Pre-Money Amount / Total Shares Held by Founder and Seed Investor

= 5,00,000/1,10,000

= 4.54

Current Value of Investment = Number of Shares Held by Investor × Series A Price per Share

Founders: 75,000 × 4.54 = 3,40,500

Seed Investors: 35,000 × 4.54 = 1,58,900

Series A Investors: 110,000 × 4.54 = 4,99,400

Adjusted Cap Table

| Investor | Original Investment | Current Value | Anti-Dilution Additional Shares | Price per Share | No. of Shares | % Holding |

|---|---|---|---|---|---|---|

| Founders | ₹750,000 | ₹340,500 | - | ₹4.54 | 75,000 | 34% |

| Seed | ₹250,000 | ₹158,900 | 10,000 | ₹4.54 | 35,000 | 16% |

| Series A | ₹500,000 | ₹499,400 | - | ₹4.54 | 110,000 | 50% |

| Total | 220,000 | 100% |

3. Narrow-Based Weighted Average Method

Adjusted Price per Share:

CP2 = CP1 *(A+B)/(A+C)

=10*(25,000+50,000)/25,000+1,10,0000

= 5.55

Conversion Ratio = Original Price per Share / Adjusted Price per Share

= 10/5.55

= 1.8

Total Shares Held by Seed Investor at the End of Series A = (Number of Shares Held as on Date × Conversion Ratio)

= 25,000*1.8

= 45,000

Additional Shares to be Issued to Seed Investor = Total Shares Held by Seed Investor - Total Shares Held Previously

= 45,000-25,000

= 20,000

Total Shares Held by Founder and Seed Investor at End of Series A

= 75,000+45,000

= 1,20,000

New Price per Share = Pre-Money Amount / Total Shares Held by Founder and Seed Investor

= 5,00,000/1,20,000

= 4.17

Current Value of Investment = Number of Shares Held by Investor × Series A Price per Share

Founders: 75,000 × 4.1.7 = 3,12,750

Seed Investors: 45,000 × 4.17 = 1,87,650

Series A Investors: 120,000 × 4.17 = 5,00,400

Adjusted Cap Table

| Investor | Original Investment | Current Value of Investment | Anti-Dilution Additional Shares | Price per Share | No. of Shares | % Holding |

|---|---|---|---|---|---|---|

| Founders | 750,000 | 312,750 | 4.17 | 75,000 | 31.25% | |

| Seed | 250,000 | 187,650 | 20,000 | 4.17 | 45,000 | 18.75% |

| Series A | 500,000 | 500,400 | 4.17 | 120,000 | 50% | |

| Total | 240,000 | 100% |

Comparative Snapshot of Anti-Dilution Methods

As illustrated, anti-dilution clauses are essential for protecting investors from the adverse effects of a down round. Among the methods, the Full Ratchet approach is the most favorable for investors, offering the greatest protection against dilution. On the other hand, the Broad-Based Weighted Average method is more common and tends to be more balanced between investors and existing shareholders.

Exceptions to the Anti-Dilution Clause

While anti-dilution clauses offer significant protection, there are specific scenarios where these clauses do not apply:

- Issuance of stock options to employees

- Issuances to strategic partners approved by the investor

- Issuances due to the conversion of outstanding warrants and other convertible instruments

- Equity shares issued as part of a stock split or similar reorganization

- Securities issued in connection with a bona fide business acquisition or IPO

Any change in the conversion price of shares should be promptly communicated to shareholders through a Board-approved notice, stating that the adjusted price under the anti-dilution clause will serve as the conversion price for any future exercise of the ‘Valuation Protection Right’.

Ultimately, being prepared is crucial. The anti-dilution clause embedded in the term sheet and other definitive agreements provides a vital safeguard for shareholders, acting as a safety net to minimize the dilution of their shareholding in the company.