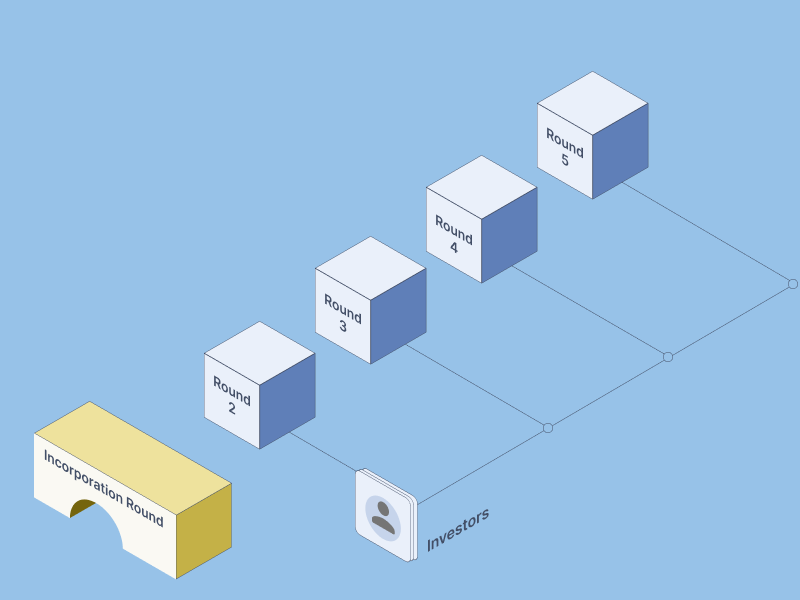

In the dynamic startup world, launching a company is just the beginning. The true challenge—and opportunity—lies in securing the funds that will propel your vision and drive growth. Fundraising is a high-stakes game where strategy, preparation, and execution converge. Each phase is crucial in shaping your startup’s future and convincing investors that your idea is not just viable but revolutionary.

The Fundraising Journey: An Overview

A fundraising round is a process where a company raises capital from external investors to fuel its growth and development. Each round of fundraising typically involves offering shares or other securities in exchange for investment.

A shareholder’s ownership stake in the company is determined by the number of shares held relative to the total shares of the company. When capital is raised against the company’s equity, the total outstanding shares increase. In the case of convertibles, the conversion to equity happens on a future date, leading to an eventual dilutive effect on shareholders’ equity. This is why most cap tables consider the values on a fully diluted basis (FDB) of shareholding, showing the exact equity value an investor would have after all potential conversions.

Preparing for a Funding Round

Fundraising can be likened to a series of strategic moves in a high-stakes chess game. Each step, from identifying the right investors to closing the deal, requires careful thought and precision. Here’s a detailed guide to navigating the fundraising process, covering key stages and essential considerations.

01.

Initial Interaction & Identification of Target Investors

The first step in any successful fundraising campaign is finding the right investors. This isn’t just about seeking anyone with financial resources; it’s about strategically identifying those who bring experience, industry knowledge, and networks that align with your startup’s goals. Conduct thorough research on potential investors, focusing on their track record, investment style, and previous engagements to ensure they’re a good fit for your company.

02.

Preparing for a Funding Round

Before embarking on a new funding round, you need to understand several key factors:

Priced vs. Non-Priced Rounds: Funding rounds can be categorized as either priced or non-priced. Priced rounds are based on a fixed valuation (i.e., a predetermined price per share), while non-priced rounds link valuation to future funding events or operational metrics, offering a more flexible approach.

Types of Financing: Financing options generally fall into three categories: equity, debt, and hybrid.

- Equity Financing: Involves issuing equity shares, which dilutes existing shareholders’ ownership but can be advantageous for companies expecting substantial growth.

- Debt Financing: Entails borrowing funds that must be repaid with interest. This option is typically pursued by companies with strong financial performance to avoid equity dilution.

- Hybrid Financing: Combines elements of both debt and equity, such as convertible notes or optional convertible preference shares.

- Equity Financing: Involves issuing equity shares, which dilutes existing shareholders’ ownership but can be advantageous for companies expecting substantial growth.

Engaging with Investors and Building a Strong Pitch Deck: Approaching investors is akin to a job interview where both parties evaluate each other’s potential. A compelling pitch deck is crucial for securing investment. Key elements include proof of concept, product innovation, affordability, target market, and marketing strategies.

03.

Execution of the Letter of Intent (LOI)

Once you’ve pinpointed your target investors, formalize your interest through a Letter of Intent (LOI). This document outlines the main terms of the investment and sets the stage for more detailed discussions. A well-crafted LOI should clearly articulate your business model, financial projections, and the value proposition for the investor. It serves as your first formal pitch, designed to spark interest and lay the groundwork for future negotiations.

04.

Crafting a Winning Pitch Deck

Your pitch deck is your chance to make a lasting impression. This presentation is more than a summary of your business—it’s a storytelling tool that communicates your vision, highlights your product’s unique value, and outlines your market strategy and financial outlook. A compelling pitch deck should capture the essence of your startup, showcasing your team’s strengths, your product’s potential, and the opportunities for growth.

05.

Signing the Term Sheet

The term sheet is where the rubber meets the road. It details the fundamental terms of the investment deal, including the company’s valuation, equity structure, and investor rights. This document serves as the blueprint for the more formal legal agreements that follow. It’s crucial to understand each term’s implications and negotiate for terms that protect your interests and set a solid foundation for future growth.

06.

Due Diligence

With the term sheet signed, due diligence begins—a comprehensive review of your business’s financials, legal standing, and operational integrity. This phase is designed to verify that everything you’ve presented to investors holds up under scrutiny. Be prepared for a deep dive into your records, intellectual property, and compliance with statutory regulations. This rigorous examination helps investors assess risks and validate the investment’s potential.

07.

Negotiating Investment Terms

Following due diligence, you’ll enter the negotiation phase to refine the terms of the investment deal. Effective negotiation involves balancing the need for funding with the desire to maintain control of your startup. This phase requires understanding the long-term impact of each term, being assertive, and ensuring you don’t sacrifice too much equity or control in exchange for capital.

08.

Documentation and Filings

Once terms are agreed upon, you need to handle the legal documentation and regulatory requirements. This includes drafting definitive agreements like the Investment Agreement and Shareholders Agreement and ensuring all legal obligations are met. Proper documentation is crucial for establishing the terms of the investment and protecting your company’s interests.

09.

Closing the Deal

The final step in the fundraising process is the actual transfer of funds and completion of post-investment tasks. This includes receiving the investment amount, finalizing legal paperwork, and making necessary regulatory filings. Successfully closing this phase marks the beginning of a new chapter for your startup, shifting the focus from securing funds to executing your growth strategy.