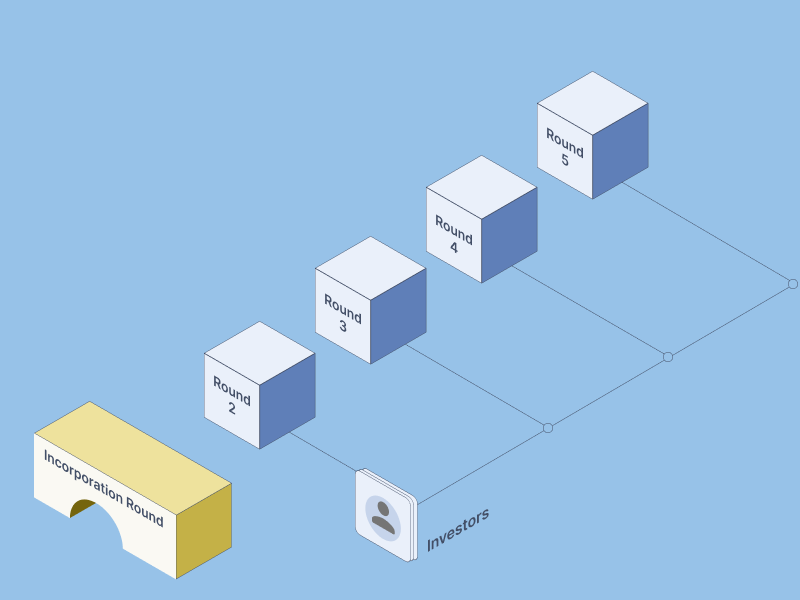

Fundraising, often viewed as a complex maze, can indeed be a prolonged and intricate process. Despite its challenges, it’s an indispensable journey that companies must embark upon to secure capital. This capital infusion is crucial for fueling growth, innovating products, and scaling operations. While there are multiple avenues to raise funds, issuing securities remains a favored method, allowing companies to attract investors by offering a share of ownership. This approach not only provides necessary financial resources but also aligns investors’ interests with the company’s success.

Each funding round is a carefully orchestrated sequence of steps, beginning with the initial pitch, through negotiations, documentation, and due diligence. Thorough preparation with all required documents can significantly streamline this process, making it smoother for both the company and its potential investors.

01.

Incorporation Documents (Pre and Post Incorporation)

A fundamental requirement for any funding round is the company’s formal incorporation. Investors will not engage with a business that is not a registered entity under the law. Essential documents include the memorandum and articles of association, a valid certificate of incorporation, and relevant statutory registrations such as GST and labor law compliance.

02.

Term Sheet

The term sheet is the cornerstone of any investment deal, outlining the terms and conditions agreed upon by the company and investors. It serves as a blueprint for subsequent agreements and typically includes clauses on company valuation, security types, shareholding patterns, investor and founder rights, anti-dilution provisions, and more. Careful drafting and negotiation of the term sheet are crucial, as it sets the stage for all future documentation and commitments.

03.

Transaction Documents

These documents formalize the investment agreement and include:

- Investment Agreements/Subscription Agreement: This outlines the agreement between the company and the investor regarding the subscription to shares.

- Shareholders Agreements: Captures the final terms of the investment deal, governing share management and company operations. Any terms not covered by the company’s articles may require amendments.

- Non-disclosure Agreement (NDA): Protects sensitive company information. While essential, requiring investors to sign an NDA might deter them, so it’s often better to limit disclosures to necessary parties like consultants under NDA.

04.

Intellectual Property (IP) Assignments/Registrations

Protecting intellectual property is vital. The company should ensure all innovations, trademarks, and proprietary information are registered and owned by the company. This includes contracts ensuring that any IP developed by employees or contractors belongs to the company. Investors will scrutinize these documents to ensure there are no risks related to IP ownership.

05.

Valuation Report/Certificate

Valuation reports are critical in priced funding rounds, determining the company’s worth and influencing share pricing and investment terms. A registered valuer, appointed with investor consent, usually handles this. The valuation report must transparently present the methods and findings used to establish the company’s value.

06.

KYC (Know Your Customer) Documentation

For receiving investment funds, the company must have a designated bank account and provide KYC documentation such as PAN, certificate of incorporation, and address proof.

07.

Conditions Precedent Compliance Certificate

Investment deals are finalized only when all conditions in the transaction agreements are met. This includes completing due diligence and obtaining necessary approvals. The director must sign a compliance certificate confirming that all conditions have been fulfilled.

08.

Foreign Inward Remittance Certificate (FIRC)

For international funds, an FIRC is required. This certificate, issued by the authorized dealer bank, confirms the receipt of foreign funds and ensures compliance with legal requirements.

09.

Closing Forms

Post-investment, several statutory forms must be filed to complete the fundraising process:

- DIR-12: For new director appointments.

- FC-GPR: Reporting foreign investment to the RBI.

- Form MGT-14: Filing resolutions related to share issuance.

- Form PAS-3: Documenting the allotment of shares.

- Form PAS-4: Private placement offer letter for shares.

- Share Certificate: Issued to investors as proof of share allotment.

- Form SH-7: For alterations in authorized share capital.